In the United States, your credit score isn’t just a number — it’s one of the biggest factors that determine how financially flexible your life can be. From qualifying for a mortgage or car loan to getting approved for a rewards credit card or even renting an apartment, your creditworthiness plays a key role. Understanding your credit score range is the first step toward using it to your advantage.

But what do the numbers actually mean? What's "good," "fair," or "excellent"? And where does your score stand compared to today's average credit score in USA? Let's take the mystery out of everything you want to know about the FICO score chart, credit score levels, and what lenders read in different credit categories in plain, down-to-earth terms.

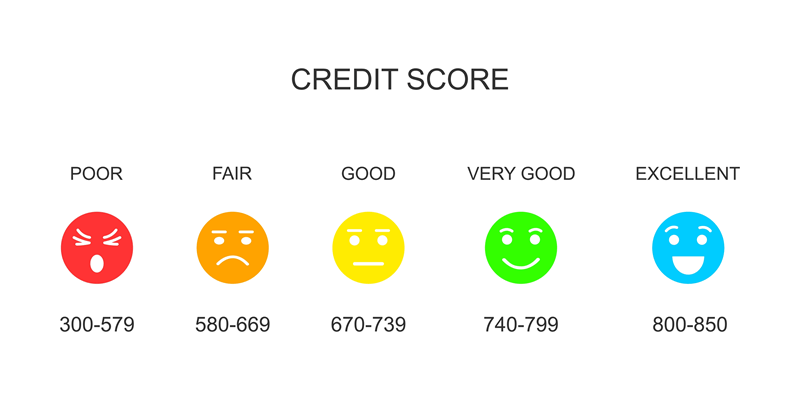

Your credit score is a three-digit summary of your overall credit. Most lenders within the United States use the FICO score chart, which ranges between 300 and 850. The higher the value, the less risk you are viewed as to lenders. Basically, it tells banks how likely you are to repay what you borrow.

The scale of credit scores is divided into groups that determine levels of creditworthiness:

These credit scores indicate how successfully you've handled debt and payments in the past. You want to move steadily higher up the scale until you reach the "excellent" level.

A "good" credit score would be 670 to 739 on the FICO scoring chart. That would tell lenders you're making consistent payments, have good credit use, and have good balances of debt. Borrowers in this range usually qualify for most credit cards, auto loans, and mortgages at fair interest rates.

When people ask, "What is a good credit score?" the answer differs modestly depending on the situation. For example:

For credit cards: 700 or higher generally gets you more rewards and lower APRs.

For auto loans: Anything above 660 is good, most lenders think.

For mortgages: Having a 740 or higher will get you the best interest rates.

A "good" score is not perfect. It simply indicates you manage your credit well, with a bit of wiggle room to "very good" or "excellent."

The latest national figures show the average credit score in USA is around 715, which makes the average U.S. citizen firmly in the "good" category. This is a sign that shoppers have taken their credit more responsibly, pay bills on time, and keep low balances.

But this average varies by age segment and geography. Young adults (18–25) will have lower scores simply because their credit histories are shorter. Older adults (55 and above) will have higher scores as a result of long, well-established credit histories and good payment behavior.

Knowing the average credit score in USA gives you a benchmark. If you're above that, you're better than average. If you're below, you have specific goals to work towards having a better range of credit scores.

To better see the implications of the numbers, let's look further at how the credit categories outlined in the FICO system translate into real-world repercussions.

This is the lowest credit score level. Borrowers in this category often have a history of missed payments, defaults, or very high credit utilization.

Scores in this area are better but still moderate risk for lenders.

This is a good place in the credit score range and indicates regular payment history.

These borrowers demonstrate outstanding credit management and a strong history.

This is the highest tier in the FICO score chart and represents outstanding credit behavior.

These credit types demonstrated exactly how your behavior determines what credit score range you're in — and how lenders interpret that range.

Your credit score range directly affects the interest you pay for borrowed money. A difference of only 50 points can change the interest rate you are eligible for. For instance, an individual with a 750 score can save thousands of dollars in interest on a 30-year mortgage compared to an individual with a 650 score.

Aside from borrowing, credit scores affect:

In short, learning the range of credit scores can help you recognize how your actions appear in real opportunities and savings.

Your position within the credit score ranges isn't random — it's based on several weighted factors. This is the way FICO generally divides it:

These five components work together to put you in a credit score range on the FICO score chart.

If your existing credit score range isn't exactly where you'd prefer, the better news is that credit score improvement is squarely in reach with consistent effort.

Below are a few suggestions to help you move up the credit score ranges:

Your credit well-being is one of the most valuable assets you can build. If you're striving to reach the "good" range or straining to "excellent," every financial decision matters. By understanding how the credit score band works, and what drives the various credit score ranges, you will be able to make more informed money decisions and create more promising opportunities for your future. The information mentioned here can be incorrect or vary, as the information on the internet is changing daily. Please cross-check before relying on it.

This content was created by AI